The Turnaround Process

Please download the white paper for further detail on the process.

You might hope and trust that a sound business assessment and a targeted business improvement plan would suffice. Say, send copies of the assessment and plan to the CEO, perhaps meet once or twice to explain your ideas and answer any questions, and watch returns increase as management implements the plan. As numerous activist investors know, it seldom works that way. Executive ego leads to cordial but fruitless discussions of your ideas, and more likely to indifference, or even willful defiance. So, an investor that wants to see management implement a business improvement plan should also create an activism plan for engaging executives (and potentially other investors, the SEC, and even the media) in the process.

An activist investor can choose from numerous strategies and tactics. Above all, the activism plan should follow logically from the business improvement plan. That seems sensible and even obvious. Yet, too many times an investor becomes frustrated with the performance of a portfolio firm, and even creates a compelling business improvement plan, but stalls by becoming active in the wrong ways. High expense levels do not necessarily require an investor to demand a board seat, or a revamped executive compensation system may not necessarily follow from the suggested sale of a failing division.

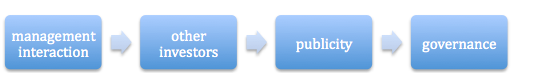

All the available strategies and tactics, then, revolve around doing whatever it takes to persuade or force management to implement the business improvement plan. One way to think about the strategy and tactics entails how you escalate the pressure on management to do this. I think of this as a rough continuum:

Copyright 2008-2014 Michael R. Levin - all rights reserved.